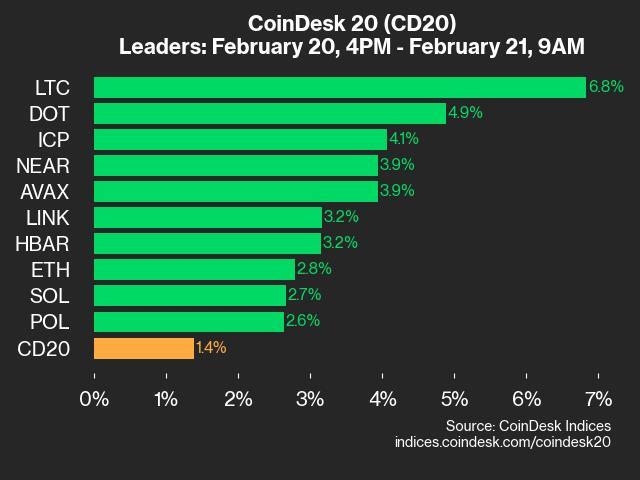

A well-balanced portfolio that includes cryptocurrencies like bitcoin or ether has the potential to offer superior returns and a higher Sharpe ratio compared to traditional portfolios made up solely of equities, bonds, or other assets, says Timothy Burgess.CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

How a Small Crypto Investment Can Improve Your Portfolio