Ethereum has surged 10% since last Friday, marking a notable bounce as the crypto market reacts to local demand levels. Despite this uptick, ETH has been lagging behind Bitcoin and other altcoins in recent months.

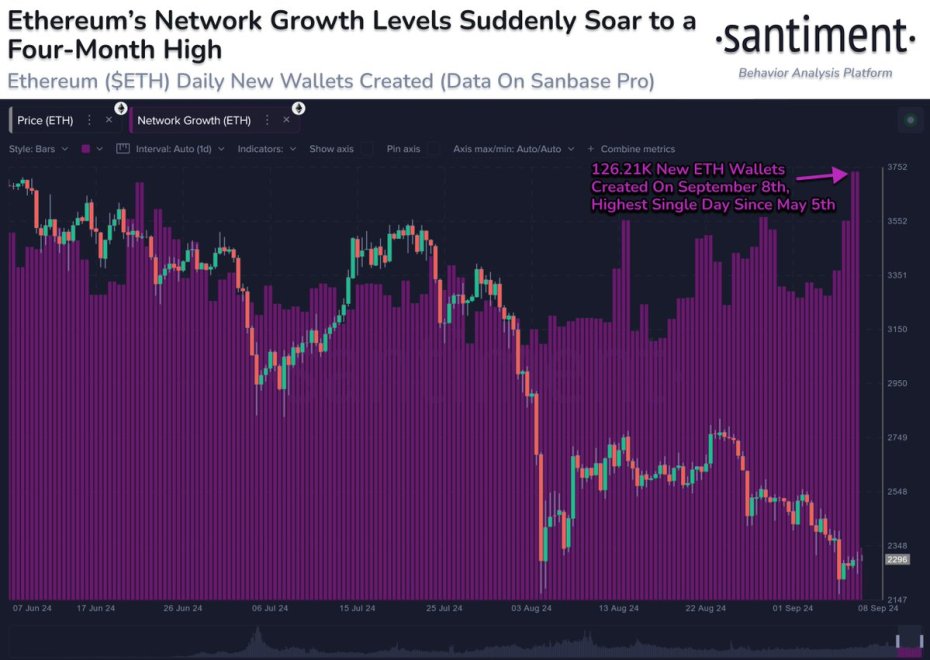

Key data from Santiment, however, highlights an uptick in network activity, hinting at a potential shift in Ethereum’s performance. Although ETH continues to face challenges in reclaiming the crucial $2,500 zone, this period of volatility could present a strategic opportunity.

Investors might want to consider this moment as a chance to position themselves for anticipated future gains. With the current momentum and increasing network engagement, Ethereum’s rally could be on the horizon, offering a promising outlook for those ready to capitalize on its rebound.

Ethereum Network Growth: A Sign Of Relief

Ethereum has been struggling recently, with traders and investors awaiting confirmation that the worst selling pressure and negative sentiment has passed. One positive signal is the increased network activity reported by Santiment on X, which could be a sign of improving conditions.

On Sunday, a day typically known for lower trading volumes, Ethereum saw a significant spike in network growth. The number of new wallets created reached a four-month high, with 126,210 new wallets added. This uptick in network utility suggests growing interest in Ethereum and may signal a shift in market sentiment.

To maintain this momentum, Ethereum’s price must target and test higher levels, particularly in the local supply zone, which is around $2,550. This price level will be crucial for Ethereum to regain strength and establish a solid upward trend.

Investors and traders closely watch for further signs of strength as the broader market enters a consolidation phase. The increased network activity could be an early indicator of a potential rally, making it essential to watch Ethereum’s price movements and overall market trends.

ETH Price Performance

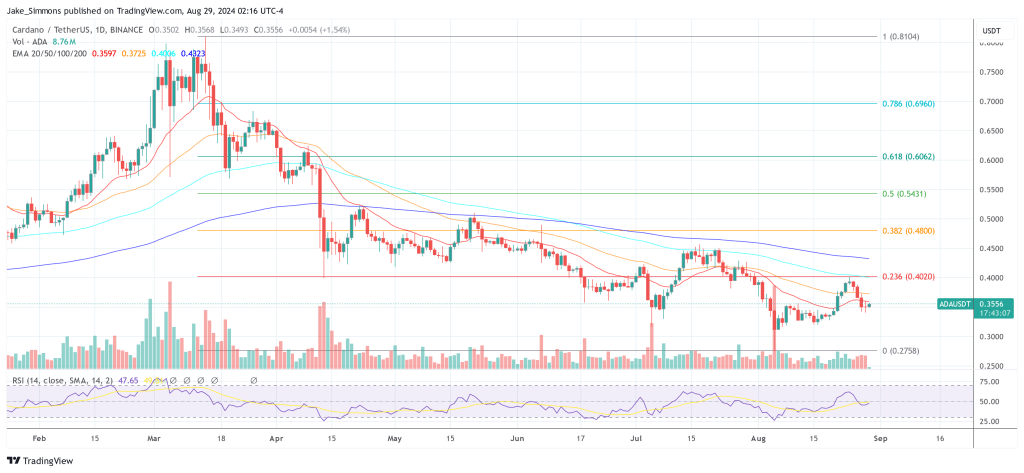

Ethereum is trading at $2,349, following a 10% rebound from yearly lows of $2,150. This surge comes after weeks of persistent selling pressure, positioning ETH at a pivotal level in its price action.

The focus now shifts to the 4-hour 200 exponential moving average (EMA) at $2,576. For Ethereum to sustain its bullish momentum, it must not only push above this key technical level but also close above it convincingly.

Since late July, ETH has struggled to maintain a position above this EMA, a significant resistance point. The failure to close above the EMA during this period has highlighted a bearish trend in the short term. A successful breakout and close above this level would suggest a potential trend reversal and could signify the start of a more sustained upward movement.

However, the situation could worsen if Ethereum fails to hold its current price levels and dips below $2,349. A drop below this support could lead to a deeper correction, potentially revisiting yearly lows or even lower levels in the near term. Such a scenario could adversely impact ETH holders, introducing increased volatility and risk.

Keeping a close eye on ETH’s interaction with the 200 EMA and its ability to hold above current levels will be crucial for assessing the near-term outlook and potential trend shifts.

Featured image from Dall-E, chart from TradingView

Bitcoinist.comRead More