A new report from Coinbase Research claims that macroeconomic pressure weighs heavily on the crypto market. Analysts expect the market to continue being vulnerable over the coming weeks because there are just too few catalysts to move the price upwards. This has a lot of investors nervous, with conditions changing globally.

Coinbase: Macro Factors At Play

Coinbase’s report underlined the rising dependency of the crypto market on broader economic events. In this regard, last week’s decision by the Bank of Japan to hike interest rates has been linked to the unwinding of yen carry trades that sent ripples through global markets.

Moreover, the renewed geopolitical tension in the Middle East appears to raise concerns over oil supplies, further muddying the water. These are not theoretical macro pressures; they do matter for investor sentiment and market stability.

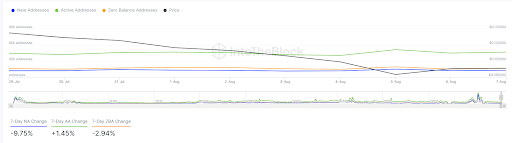

According to analysts at Coinbase, leverage within on-chain spot markets has fallen sharply, which could also mean that the recent large drop has made investors rather cautious.

They believe that, since there are no immediate catalysts, the near-term price movements of crypto would continue to be dominated by macroeconomic factors.

Q3 Strategies

Looking into the future, Coinbase heads into Q3 2024 in a cautious position. The company outlook was based on the next data prints for US inflation, which could render the temperament in the markets.

When the figure comes out, it could spur confidence or continue to disillusion investors on crypto. In the absence of positive news or developments regarding crypto, price momentum may be difficult to generate.

Analysts are not all pessimistic, however. There could be a recovery in token valuations in the event of a recovery in the US economy, they said.

They even hypothesized that Bitcoin could reach its all-time high later this year if macro conditions stabilize. This divergence in outlook reflects the uncertainty that currently characterizes the crypto market.

The Road Ahead For Investors

For investors to move effectively in the current crypto landscape, it will call for keenness with respect to the interplay between macroeconomic factors and market dynamics.

Any person can easily point out that this correlation has been interacting between cryptocurrencies and traditional financial markets, something that is evident since institutional investors came into the space.

As the market matures, it’s important for investors to remember that cryptocurrencies are no longer isolated assets but are driven by larger economic trends.

Featured image from Pixabay, chart from TradingView

Bitcoinist.comRead More