On-chain data shows the Bitcoin diamond hands holding since more than five years ago have continued to be stalwart despite the latest crash.

Over 30% Of The Entire Bitcoin Supply Hasn’t Moved In 5 Years Or More

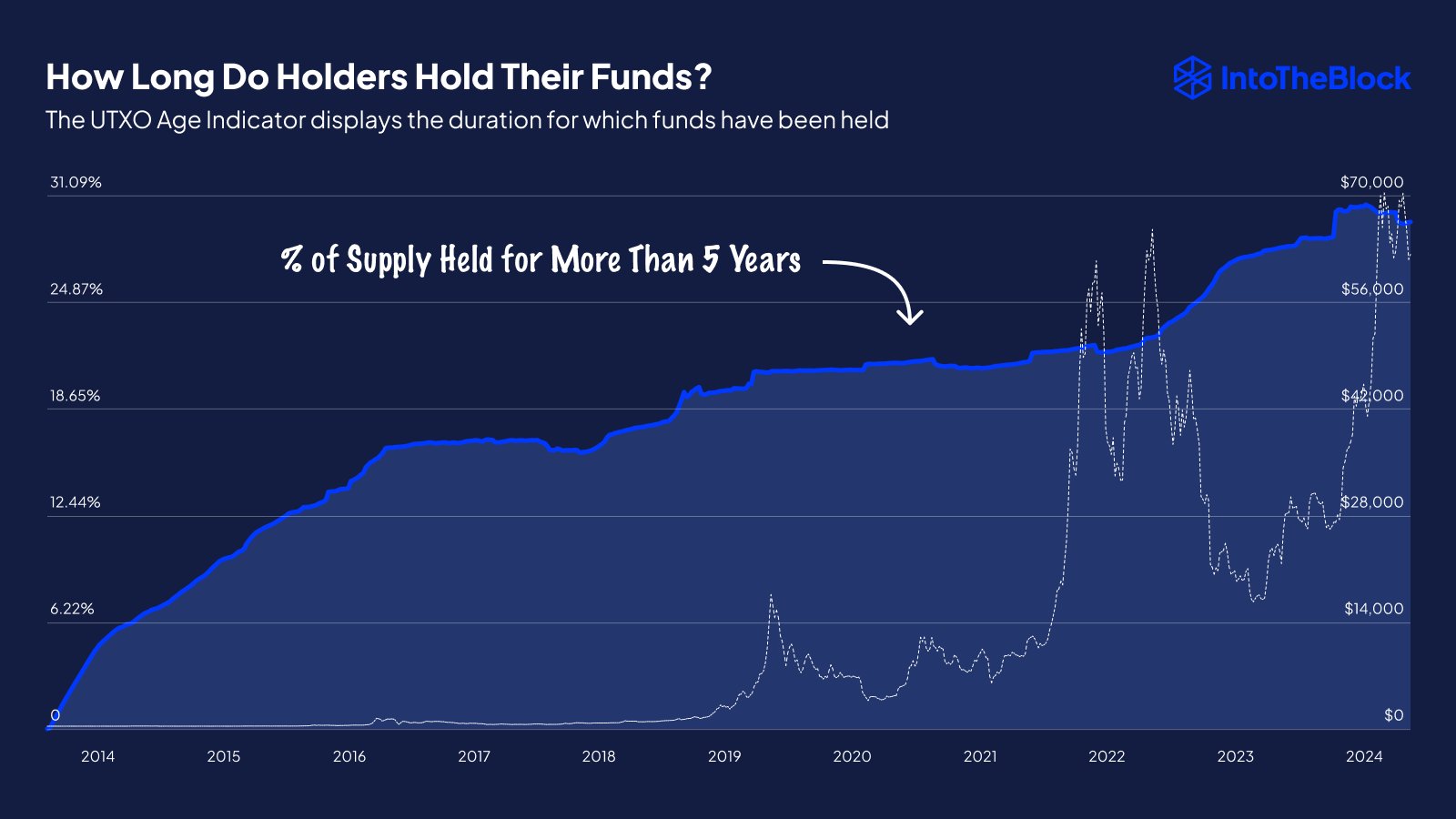

In a new post on X, the market intelligence platform IntoTheBlock talked about what the percentage of the total circulating Bitcoin supply held by the investors who bought more than five years ago looked like recently.

Statistically, the longer a holder keeps their coins (or, to be more precise, UTXOs) dormant, the less likely they become to transfer or sell them on the network. As such, the “long-term holder” (LTH) cohort is considered to carry the relentless hands of the market.

IntoTheBlock defines LTHs as the investors who bought at least a year ago, so the holders who are of focus in the current discussion, those staying silent since at least five years ago, would be considered the most resilient of hands even among these LTHs.

Something to note, though, is that when coins age past the five-year mark, chances that they did so by becoming lost rise. Their keys have become misplaced, or their existence has been forgotten, meaning they will likely never return to circulation.

Nonetheless, a lot of the supply would still correspond to HODLing behavior. As IntoTheBlock notes, “while some of this could be attributed to lost funds, a majority likely belongs to long-term holders.”

Now, here is a chart that shows the trend in the supply held by this especially old segment of the LTHs over the past decade:

As is visible in the above graph, the supply of these diamond hands had decreased earlier in the year, suggesting that some of these investors had decided to move their coins, possibly for selling.

From the metric’s trajectory in the chart, it’s clear that this event was quite rare, as these resolute LTHs don’t participate in selloffs. Since the drawdown, though, the indicator has been back on its upward trajectory, potentially suggesting the cohort’s selling appetite has already calmed down.

The latest crash in the cryptocurrency that has taken its price to its lowest levels since February has also naturally not been able to make these veterans panic, for they have already withstood deeper plummets. “This shows that despite market fluctuations, there is a strong core of Bitcoin believers,” notes IntoTheBlock.

This segment of the Bitcoin LTHs currently controls more than 30% of the supply, implying that a third of the cryptocurrency’s entire supply hasn’t moved in over five years.

BTC Price

At the time of writing, Bitcoin is trading at around $55,600, down more than 9% over the past week.

Bitcoinist.comRead More