The German government is continuing to actively liquidate portions of its substantial Bitcoin (BTC) holdings, transferring significant sums to various cryptocurrency exchanges and wallets, according to data from Arkham Intelligence. This wave of transfers includes the recent movement of $24 million worth of Bitcoin, underscoring a broader strategy that may be influencing Bitcoin’s current market dynamics.

German Gov’t Progresses With Bitcoin Liquidation Strategy

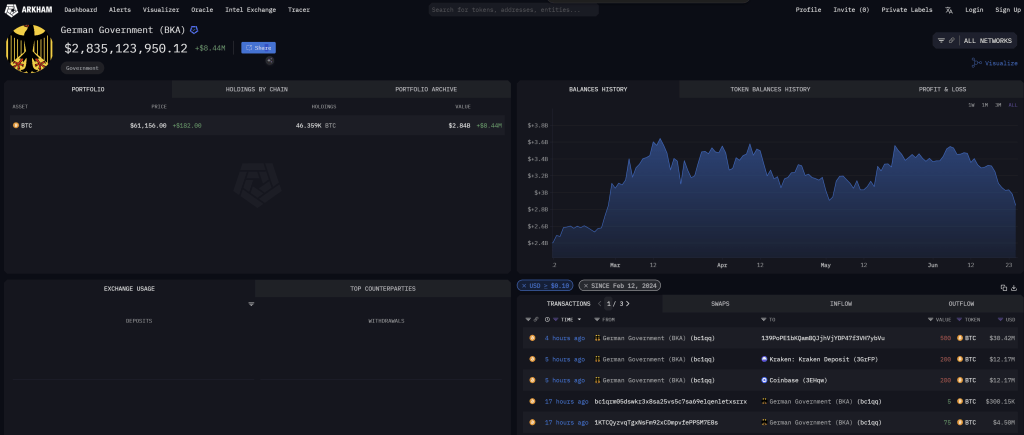

On June 25, the Federal Criminal Police Office (BKA), operating a government-labeled cryptocurrency wallet, moved 900 BTC across three separate transactions. Two of these transactions, each involving 200 BTC, were sent to prominent exchanges Coinbase and Kraken. Additionally, a larger transfer of 500 BTC was directed to an address tagged as “139Po”, a wallet whose activities and ownership remain unclear, despite previous interactions with the German government’s wallet.

“UPDATE: German Government selling additional $24M BTC. In the past 2 hours the German Government has moved 400 BTC to exchange deposits at Kraken and Coinbase. They have also moved 500 BTC to address 139Po. We have yet to see where these funds are moved,” Arkham Intel reported via X.

These transactions are part of a larger pattern of Bitcoin sales by the government, which had previously transferred $130 million BTC on June 19 and $65 million BTC on June 20. The transactions from June 19 and 20 saw some funds returning from Kraken and smaller amounts from wallets associated with Robinhood, Bitstamp, and Coinbase. Initially, the wallet accumulated nearly 50,000 BTC, seized from the operator of the pirated movie website Movie2k.

“This is in addition to $130M BTC sent to exchanges on 19th June and $65M BTC sent on 20th June, although they received $20.1M back from Kraken and $5.5M from wallets linked to Robinhood, Bitstamp and Coinbase. Currently, the German Government holds 46,359 BTC, worth $2.8B at current prices,” Arkham added.

The ongoing sell-off appears to have contributed to recent price pressures on Bitcoin, which has seen a decline of 11.7% over the past month and over 6.2% weekly, currently trading just above $61,000. Analysts suggest that the German government’s actions on centralized exchanges (CEXs) are a notable factor behind BTC’s weak performance.

Looking forward, the market downturn might be further exacerbated in July as the defunct crypto exchange Mt. Gox plans to start repaying its creditors. With more than 140,00 BTC worth $9.4 billion to approximately 127,000 creditors, the market could face additional selling pressure, potentially driving prices down further. However, as suggested by Galaxy Digital’s head of research, Alex Thorn, the selling pressure might be overestimated vastly by the market.

At press time, BTC traded at $61,159.

Bitcoinist.comRead More