Based on on-chain data, the Head of Research at the analytics firm CryptoQuant has explained how Bitcoin has been looking less bullish recently.

Bitcoin Bull-Bear Market Cycle Indicator Has Seen A Decline Recently

In a new post on X, CryptoQuant Head of Research Julio Moreno shared what the latest trend in the Bitcoin Bull-Bear Market Cycle Indicator has been looking like. This indicator is based on another metric developed by the analytics firm: the P&L Index.

The P&L Index is a valuation indicator for Bitcoin that may determine whether the coin’s price is undervalued or overvalued. This metric combines the data of three popular indicators related to profit and loss to find its value (MVRV Ratio, NUPL, and SOPR).

Historically, the P&L Index’s interactions with its 365-day moving average (MA) have carried some significance for the cryptocurrency. A cross for the indicator above this line has signaled a shift to a bull phase, while a drop below has meant a transition to a bearish regime.

Now, what the Bitcoin Bull-Bear Market Cycle Indicator, the actual metric of interest here, does is that it takes the P&L Index and measures its distance from this important MA.

When the value of this indicator is greater than zero, it suggests BTC is in a bull market, as the P&L Indicator is above its 365-day MA. Similarly, the metric assuming a negative value implies an active bear market.

Below is the chart for this CryptoQuant indicator over the past year:

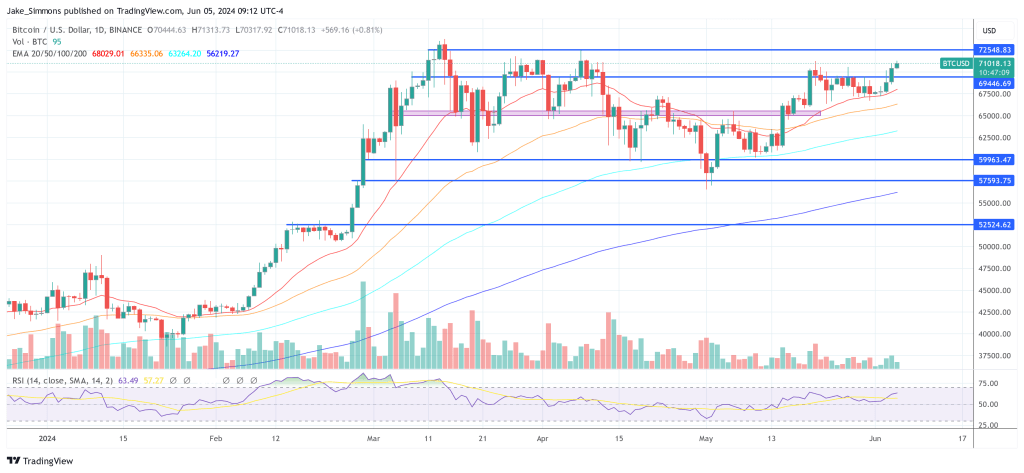

The above graph shows that the Bitcoin Bull-Bear Market Cycle Indicator shot high during the rally, leading to a new all-time high (ATH).

Generally, the higher the metric’s value, the more overpriced the asset could be considered. During the ATH break, the indicator attained levels associated with an “overheated bull,” which may be why the cryptocurrency hit a top back then.

Since the cryptocurrency has consolidated, the indicator’s value has cooled off. It’s still above the zero level, implying that BTC is in a bull market, but the coin has become less hot. “The Bitcoin market is the least bullish since September 2023,” notes Moreno.

In September 2023, the asset was moving sideways around lows, and this consolidation eventually led to fresh bullish momentum. As such, the indicator cooling off may not be bad for the asset.

It remains to be seen, though, whether the indicator has finished its drawdown or if it will cross into the negative territory. In such a scenario, the market would have transitioned towards a bearish one instead.

BTC Price

At the time of writing, Bitcoin is trading at around $61,600, down more than 5% over the past week.

Bitcoinist.comRead More