The legal battle between Custodia Bank and the US Federal Reserve (Fed) is nearing a pivotal juncture, with implications that could reshape the financial landscape for crypto businesses across the country. The dispute centers on Custodia Bank’s quest to secure a master account from the Fed, a crucial step for the bank’s operations that would facilitate direct access to the FedWire network, essential for executing large-volume, real-time payment transfers.

Fox Business’s Eleanor Terrett brought to light comments from Peter Conti-Brown, a renowned financial historian and professor at the Wharton School, which suggest an impending defeat for the Federal Reserve in this landmark case. Conti-Brown, involved as an expert on behalf of the plaintiffs, shared his interpretation of recent judicial developments on X (formerly Twitter):

The court issued an order canceling the trial re the Fed’s management of access to a Master Account… I think this means the Fed is about to lose, as it should.

Conti-Brown’s assertion is grounded in the court’s own statements, which emphasize the comprehensive review of the summary-judgment briefing and materials submitted by all parties. The court noted, “Based upon this review, the Court currently does not find a decision on the merits depends on a disputed material fact, and the claims and issues can be resolved based upon the extensive record currently before it.”

This suggests a readiness to decide on the case’s merits without proceeding to trial, a move interpreted by many as unfavorable to the Fed’s position.

Why It Matters For The US Crypto Industry

Custodia Bank, which has positioned itself as a crypto-friendly bank, filed its application for a master account in October 2020. The bank argued that having direct access to the Federal Reserve, rather than going through intermediary banks, would allow it to reduce costs and enhance its digital asset strategy, thereby introducing new financial service products and creating a bridge between digital assets and the US dollar payment system.

However, the Federal Reserve has been hesitant to approve Custodia’s application, citing concerns over “novel risks” associated with granting such access. Despite a typical review timeline for master account applications being 5-7 days, Custodia’s application has faced delays, leading the bank to file a lawsuit alleging an “unlawful delay” under the Administrative Procedures Act (APA).

In November, the court ruled in favor of Custodia, stating that it had made a plausible claim of unreasonable delay against the Board and the Kansas City Fed, thus denying the Fed’s motion to dismiss the case. This ruling marked a significant victory for Custodia, allowing it to continue its legal challenge.

The Federal Reserve Board later announced its denial of Custodia Bank’s application to become a member of the Federal Reserve System. Custodia Bank’s victory in its legal case against the US Federal Reserve could mark a watershed moment for the US crypto industry.

The reality of Operation Chokepoint 2.0 has been confirmed by the findings of the October Office of Inspector General (OIG) report, which highlighted the Federal Deposit Insurance Corporation (FDIC)’s restrictive actions towards the crypto industry. These include the issuance of “pause letters” that effectively instruct banks to halt the onboarding of new cryptocurrency clients, a move that has sidelined newcomers to the field.

Moreover, the FDIC mandates that all US banks must obtain prior approval for any crypto-related activities. However, it has failed to establish clear criteria for what constitutes acceptable crypto activities and has not provided a definitive timeline for decision-making. This regulatory ambiguity has led to a near-total withdrawal of US banks that had previously catered to the crypto sector.

The triumph of Custodia Bank would not only signify its emergence as a reliable and stable banking ally for crypto enterprises but also comes at a critical juncture when the industry desperately needs credible banking solutions. This need stems from the banking crisis in March 2023, during which the cryptocurrency world witnessed the collapse of three pivotal banking institutions: Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank.

These banks were cornerstone entities in the crypto ecosystem, offering essential banking services and infrastructure support. Their consecutive failures in a single week precipitated a scenario described as the “unbanking” of the US cryptocurrency industry. Each bank had fulfilled a vital role, with Silvergate and Signature operating critical payment networks like SEN and Signet and servicing prominent crypto firms such as Binance.US, Kraken, and Gemini.

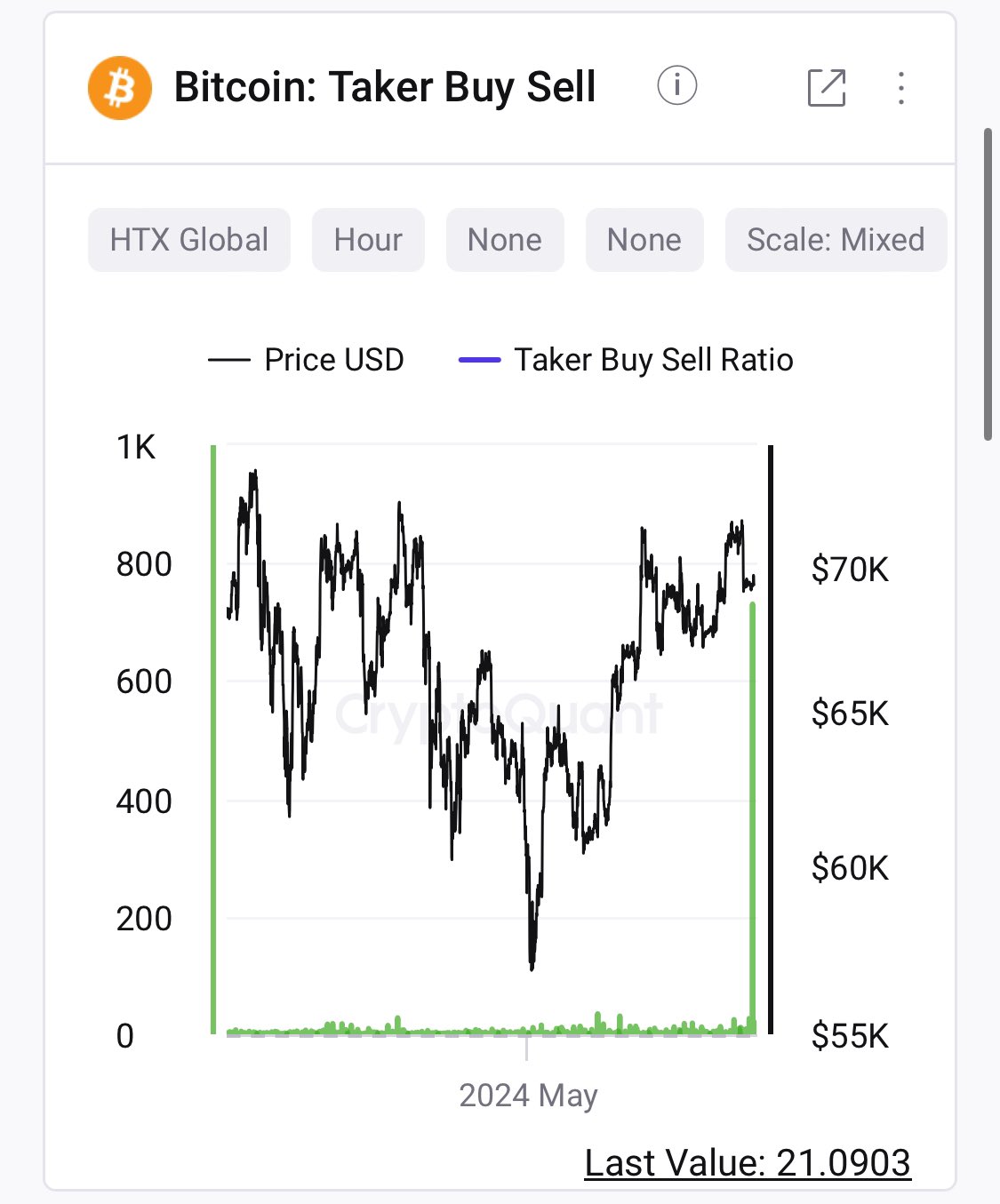

At press time, Bitcoin traded at $66,392.

Bitcoinist.comRead More