Ark Invest’s CEO Cathie Wood predicts there will only likely be Bitcoin and Ethereum spot ETFs in the US. This is based on her belief that the Securities and Exchange Commission (SEC) will unlikely approve funds that do not hold the two most significant crypto tokens by market cap.

Only Bitcoin and Ethereum Have The SEC’s Blessings

During an interview with WSJ’s Take On The Week podcast, Cathie Wood mentioned that it would be surprising to see “anything but Bitcoin and Ether being approved by the SEC.” This echoes the sentiments of experts who have predicted in the past that a fund like an XRP ETF is unlikely to launch anytime soon.

Meanwhile, people like Steven McClurg, Chief Investment Officer at Valkyrie Investments, have suggested that the Spot Bitcoin ETFs and the potential approval of a Spot Ethereum ETF could usher in ETF filings relating to other tokens.

It is worth mentioning that Cathie Wood’s Ark Invest is one of the issuers of the existing Spot Bitcoin ETFs (ARK 21 Shares Bitcoin ETF). The asset manager has also applied to the SEC to offer a Spot Ethereum ETF.

However, nothing suggests that ARK Invest plans to file for ETFs for other crypto tokens, and Wood’s recent comment explains why.

Although the SEC has yet to approve the pending Spot Ethereum ETFs, industry experts are optimistic that the Commission will authorize them just like it did with the Spot Bitcoin ETFs. Bitwise’s Chief Investment Officer stated during a panel discussion at the Exchange ETF conference that it “is probable we will get an ETH ETF reasonably soon.”

Why The SEC Is Unlikely To Approve Other Crypto ETFs

Bloomberg analyst James Seyffart has previously given insights into why the SEC is unlikely to approve other crypto ETFs, specifically an XRP ETF. He suggested that XRP futures must be traded on a regulated market like the Chicago Mercantile Exchange (CME) before the SEC can consider any applications.

This aligns with the SEC’s concerns about a potential market manipulation relating to these crypto tokens. The Commission had previously rejected the Spot Bitcoin ETF applications on that ground but had no choice but to approve them when the court ruled in Grayscale’s case that the futures and spot market are correlated.

Bitcoin futures were actively trading on the CME, and Bitcoin futures ETFs were already in existence, so Grayscale could easily argue that the Spot market deserved the same treatment as the futures market.

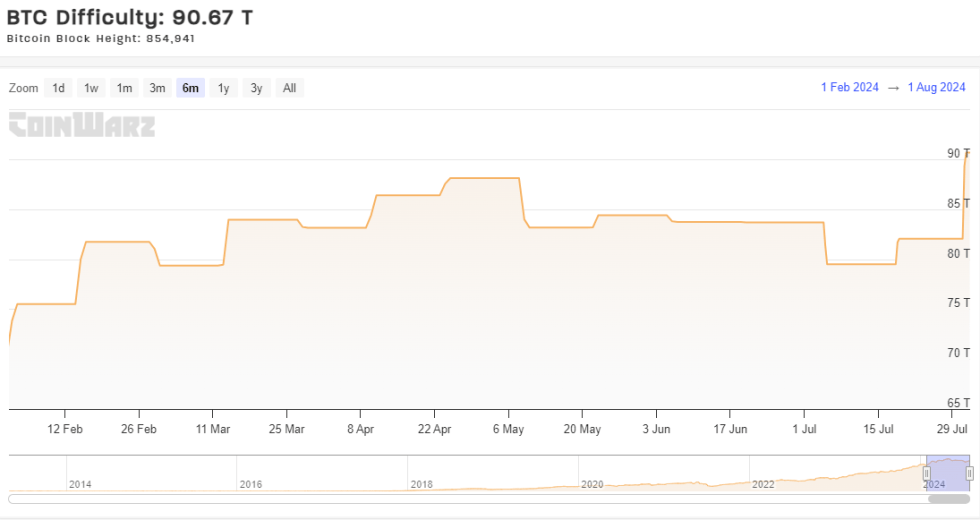

Chart from Tradingview

Bitcoinist.comRead More