In a recent development, Genesis Global, the bankrupt cryptocurrency lender, has settled a lawsuit filed by New York Attorney General Letitia James, as reported by Bloomberg.

The lawsuit alleged that Genesis defrauded customers of its now-terminated Gemini Earn program, which was jointly operated with the crypto exchange Gemini. The settlement, subject to approval by a bankruptcy judge, aims to return assets to former Earn customers and other creditors instead of state authorities.

Genesis Settles Lawsuit Over Gemini Earn Program

Under the settlement terms, Genesis will resolve the allegations without admitting liability. The parent company, Digital Currency Group (DCG), and Gemini are not included in this settlement, as it exclusively addresses the allegations against Genesis. As part of the agreement, the failed crypto lender has also agreed to cease conducting business in New York.

The lawsuit, initially filed by Attorney General James in October, accused Genesis, Digital Currency Group, and Gemini of defrauding customers of $1.1 billion. However, the settlement disclosed in the New York bankruptcy court focuses solely on Genesis.

New York authorities have offered to prioritize Genesis creditors in the Chapter 11 repayment process, regardless of whether the debt is repaid in cryptocurrency or cash.

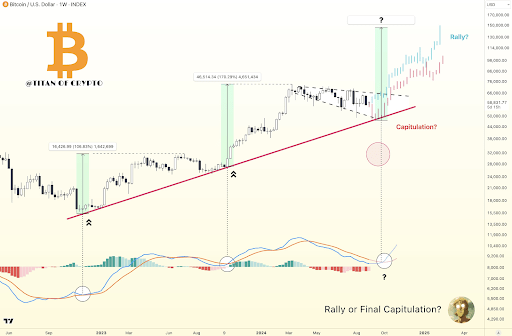

Genesis had proposed returning Bitcoin (BTC) and other tokens to clients whose digital assets were frozen due to the bankruptcy. However, the judge will decide on the repayment method, and he or she may require repayment in cash.

Furthermore, major creditors have agreed to procedures that would value digital assets closer to their current market value, considering the substantial increase in crypto prices since Genesis filed for Chapter 11 in January 2023. Other bankrupt cryptocurrency firms typically value digital assets when filing for Chapter 11.

Opposition Over Liquidation Plan

As Bitcoinist reported earlier this week, Digital Currency Group opposes the proposed liquidation plan, arguing that it would unfairly benefit some creditors in Chapter 11.

Genesis, operating independently in bankruptcy proceedings, will seek approval from Judge Sean Lane on February 14 for the New York settlement and the proposed liquidation plan.

The Gemini Earn program allowed customers to earn interest payments by lending their digital assets. The US Securities and Exchange Commission (SEC) alleged that this constituted the offering of unregistered securities.

Attorney General James accused Gemini of failing to disclose the lending risks through the Earn program. Additionally, she accused the lending company and Digital Currency Group of attempting to conceal over $1 billion in losses following the crypto hedge fund Three Arrows Capital (3AC) collapse.

Overall, the settlement represents a significant development in the legal proceedings surrounding Genesis Global and its Gemini Earn program. As the case progresses, the approval of the settlement and the proposed liquidation plan will determine the path forward for Genesis and its creditors.

Featured image from Shutterstock, chart from TradingView.com

Bitcoinist.comRead More