Gold-backed cryptocurrencies are outperforming the wider market amid a historic rally for the precious metal, which is up around 9.7% so far this year to a new record of $2,880 per ounce amid growing trade war tensions.

PAX gold (PAXG) and Tether gold (XAUT) have benefitted greatly from the precious metal’s rise, both rising roughly 10% in line with the spot price of gold. Each of these tokens is backed by one troy ounce of gold stored in a vault.

Unsurprisingly, in the traditional market, gold miners’ stocks have also surged. VanEck Gold Miners ETF (GDX), an exchange-traded fund (ETF) that tracks gold miners, has risen nearly 20% this year, outperforming the S&P 500.

The price action has seen the supply of these tokens grow, with token mints outpacing burns by millions of dollars weekly. Transfer volumes for gold-backed cryptocurrencies, according to RWA.xyz data, have meanwhile surged more than 53.7% month over month.

Gold’s price has risen this year over tariff threats from both the U.S. and China, the Spring Festival holidays in the latter country and a broader trend of growing demand. Last year, demand for the precious metal hit 4,945.9 tons, worth around $460 billion, according to the World Gold Council.

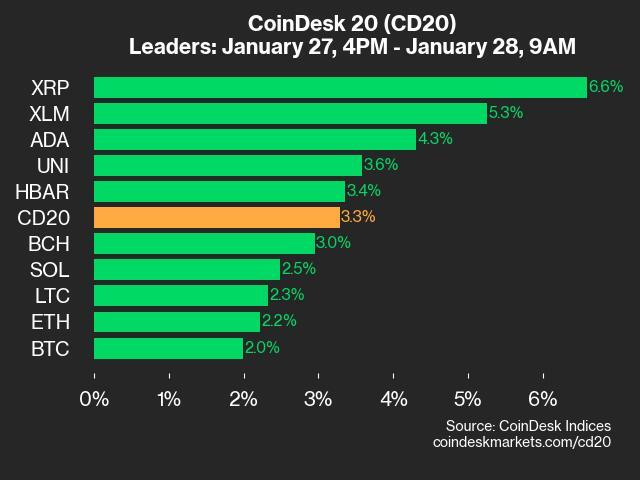

Meanwhile, most major cryptocurrencies have struggled so far this year. Bitcoin saw a modest 3.6% rise, leading the bitcoin-gold ratio to a 12-week low, while ether is down more than 17.6%. The CoinDesk 20 index is up just around 0.5%.

“Gold’s rally and bitcoin’s dip aren’t a failure of the ‘digital gold’ narrative — they’re a setup,” Mike Cahill, core contributor to the Pyth Network, told CoinDesk in a written statement. “Right now, trade war fears and a strong dollar are fleeing a flight to traditional safe havens, but once liquidity returns and risk appetite rebounds, bitcoin could catch up in a big way.”

“Smart investors know BTC is still the hardest asset next to gold, and when Trump’s pro-crypto stance materializes into actual policy, bitcoin stands to benefit massively,” he said.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data