Ethereum is struggling to break through key resistance levels, even after the recent crypto market surge led by Bitcoin. While ETH’s price remains under pressure, there’s encouraging news for investors. Recent data from IntoTheBlock highlights Ethereum’s continued dominance in decentralized exchange (DEX) volume, reinforcing its position as a major player in the DeFi space.

This insight is vital for those concerned about Ethereum’s price underperforming compared to Bitcoin and other altcoins. The data suggests that despite the current price struggles, Ethereum’s network remains robust and highly utilized, especially in DeFi.

This broader market perspective can help investors stay informed and make better long-term decisions, focusing not only on price but also on Ethereum’s underlying strength and growing utility. As the market continues to evolve, Ethereum’s role in DeFi could remain a critical factor driving future price action.

Ethereum DEX Dominance Could Be Challenged

One of the core products born out of DeFi is the decentralized exchange (DEX), allowing users to trade assets permissionlessly without the need for intermediaries. DEXs also enable users to become market makers by supplying liquidity to asset pairs, earning fees from trades between those pairs.

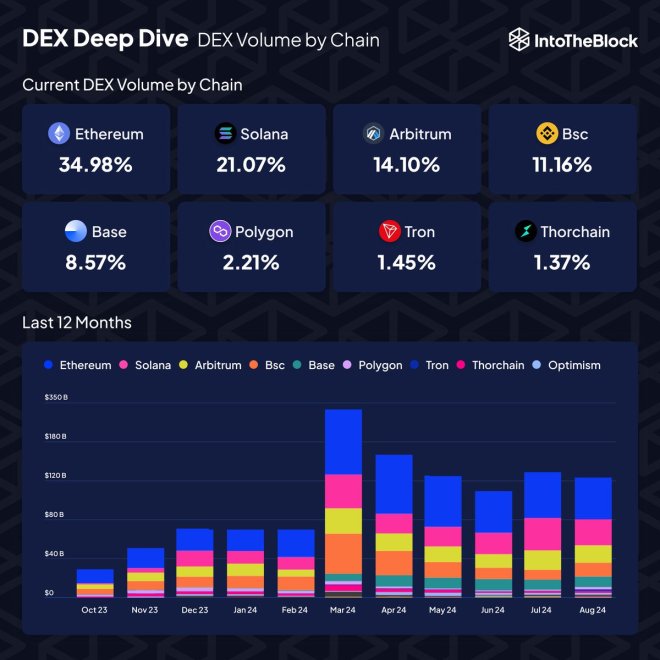

According to a recent IntoTheBlock report on X, Ethereum remains the dominant force in DEX volume, controlling almost 35% of the total market share. However, other blockchain networks are increasingly challenging Ethereum’s dominance. Solana, in particular, is emerging as a strong competitor, steadily solidifying its position within the DEX space. Solana’s increasing volume highlights its growing relevance despite Ethereum’s longstanding influence.

Other blockchains, such as Arbitrum and Binance Smart Chain (BSC), also hold a substantial share of the DEX market, with Arbitrum accounting for 14% of total DEX volume and BSC capturing 11%.

These networks continue to gain momentum as they offer faster transaction speeds and lower costs, making them attractive alternatives for decentralized trading. While Base, a new player, experienced rapid early growth, it has since leveled off, indicating the fierce competition within the DeFi landscape.

The competition to lead in the DEX market is intensifying, with various blockchain ecosystems striving to grow their market share. Ethereum’s vast liquidity and established user base give it a strong advantage, but Solana, Arbitrum, and BSC are rapidly gaining ground.

ETH Technical Analysis

Ethereum (ETH) is currently trading at $2,427 following a 5% surge on Friday. Despite this recent uptick, ETH has been underperforming during this cycle, with the latest price action showing similar struggles. The price has faced difficulty breaking past the $2,460 resistance and has yet to test the 4-hour 200 exponential moving average (EMA) at $2,534.

This persistent resistance is fueling fear and uncertainty among investors, suggesting a potential retrace to lower levels. Support levels to watch include $2,300 and, if further declines occur, a deeper dip around $2,150.

Conversely, if ETH manages to reclaim and hold above the 4-hour 200 EMA, the outlook could shift positively. Successfully surpassing this critical level might position ETH for a potential rally toward $2,600 or even higher, providing a more bullish scenario. The market’s direction hinges on whether ETH can maintain momentum above the EMA or if it will face continued resistance and a possible consolidation at lower levels.

Featured image from Dall-E, chart from TradingView

Bitcoinist.comRead More