World’s leading crypto asset management company, Grayscale has unveiled a new report, shedding light on a significant shift in American voters’ perceptions and sentiments towards cryptocurrencies post Spot Bitcoin ETFs approval. The report also provides insights into whether Americans view Bitcoin as a possible hedge against the rising inflation in the United States.

US Voters See Bitcoin In Future Investment Plans

According to Harris Poll’s latest longitudinal survey created on behalf of Grayscale, a significant portion of American voters are now more informed and engaged with cryptocurrencies following the approval of Spot Bitcoin ETFs by the United States Securities and Exchange Commission’s (SEC) on January 10.

The report was released on May 28, in an X (formerly Twitter) post, detailing the results of an extensive online survey conducted on 1,768 adults within the United States between April 30, and May 2, 2024. The survey focused on adults aged 18 and above, who plan to vote in the upcoming US presidential elections slated for Tuesday, November 5, 2024.

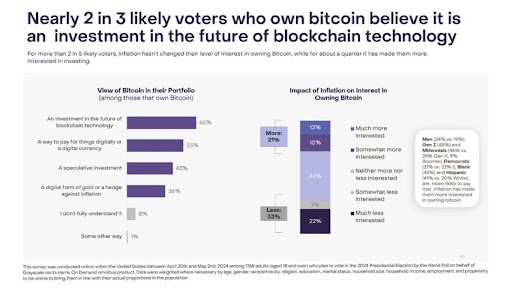

Grayscale’s report highlights American voter’s “feelings” towards digital currencies, emphasizing that two out of three voters Bitcoin owners view the pioneer cryptocurrency as an investment in the future of blockchain technology.

Creating a hierarchical system to gauge voters’ perceptions of Bitcoin in their future portfolios, the Harris poll revealed that more than 65% of American voters see Bitcoin as a future investment in blockchain technology. On the other hand, 53% view Bitcoin as a means of digital payment or a digital currency.

Additionally, 43% of American voters consider the pioneer cryptocurrency a speculative investment, while another 36% see Bitcoin as a form of digital gold or a hedge against inflation. The remaining 9% of surveyed voters were unable to provide a clear understanding of Bitcoin.

Inflation Crisis Drives US Voters Crypto Sentiment

Grayscale’s report also disclosed that a substantial number of American voters are turning to Bitcoin as a potential solution amidst geopolitical pressures and rising inflation. The survey showed that more than two out of five voters are waiting for clearer regulations and policies before considering cryptocurrency investments.

The survey included adult men and women, Gen Z, millennials, Black Americans, and Hispanics. Among them, 47% disclosed plans to eventually incorporate cryptocurrencies in their future portfolio. 44% indicated they were waiting for additional policies and regulatory frameworks before investing in cryptocurrencies.

Additionally, 42% emphasized that they were closely monitoring Bitcoin and other crypto assets in light of geopolitical tensions, inflation and the depreciation of the US dollar. Lastly, 39% disclosed that they were holding off on crypto investments until the economy showed signs of improvement.

According to Grayscale’s report, 21% of surveyed individuals are expressing significant interest in Bitcoin amid inflationary pressures. Conversely, 44% remain uninterested, while fewer than 33% are notably less interested in owning Bitcoin as a hedge against inflation.

Bitcoinist.comRead More